Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58% of the U.S., a new report says.

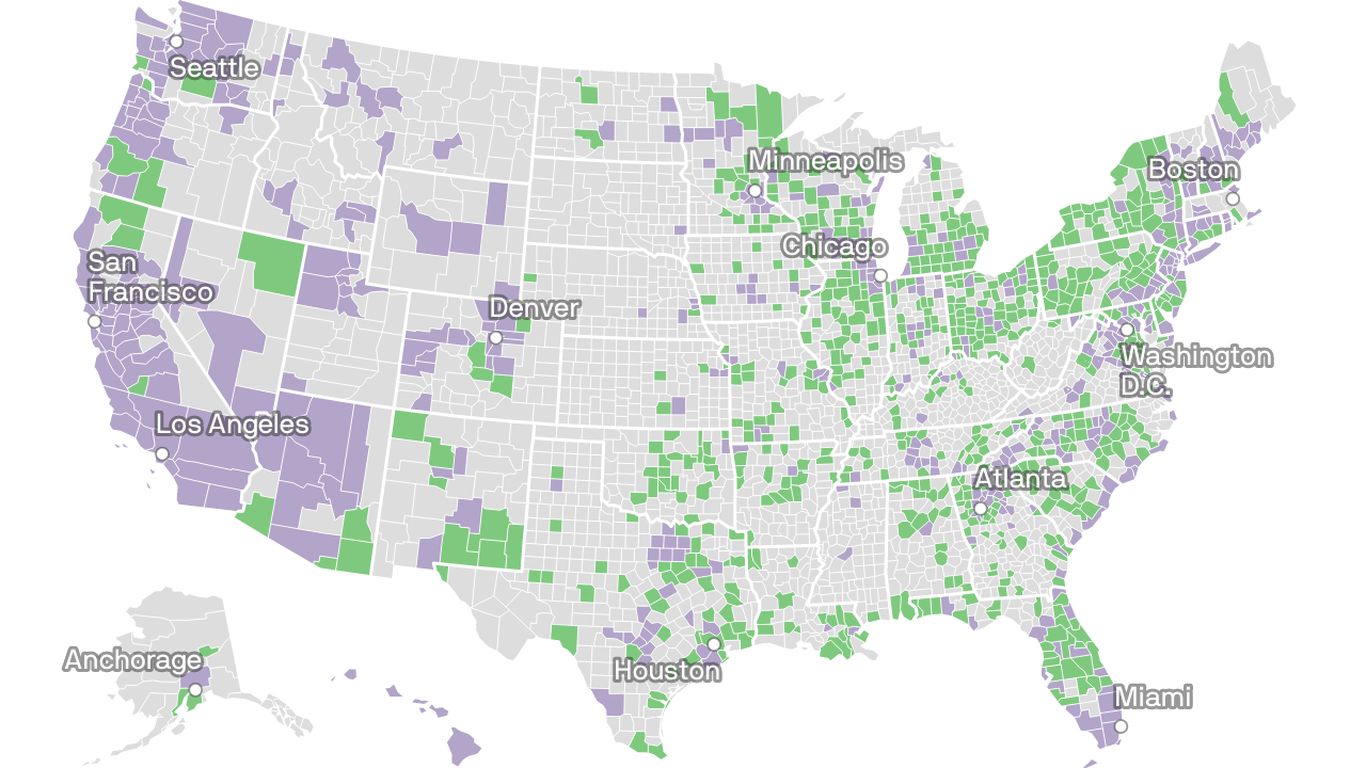

There's a big city/suburban divide, though: Renting makes more sense in big metropolitan areas, while homeownership wins out in rural areas and suburbs, where property prices are lower.

Why it matters: Even with home prices continuing to climb, the affordability gap is narrowing, which may signal the imminent end to what's been a steady run-up in home prices.

Driving the news: A new report by ATTOM, the big real estate database company, shows that the more populous a county, the more likely it is that renting will be cheaper than owning, and vice versa.

- The most affordable homeownership markets are in the South and Midwest, and the least are in the West and Northeast.

- The results were similar to 2021, with "the benefits of rising wages and super-low mortgage rates counteract[ing] the effects of home prices spiking," ATTOM said.

But: In nearly 90% of the nation, home prices are rising faster than wages.

- And homeownership remains elusive for average workers: In about half the country, buying a house would consume at least a third of their paycheck — more than mortgage lenders like to see.

What they're saying: "The good news is that for average wage earners who can afford a down payment, owning in a majority of the country takes a smaller percentage of their income and offers a chance to build equity and wealth," says Todd Teta, chief product officer at ATTOM.

- "That's also good for owners looking to sell because it widens the pool of potential buyers."

- As for surging housing prices: "The combination of rising wages, increasing employment and mortgage rates hovering around 3% are cushioning the blow," Teta says.

Details: According to Mortgage Professional America, a trade publication, renting was marginally less expensive than buying in eight of the 10 most populous states at midyear 2021: New York, Pennsylvania, Ohio, Michigan, Illinois, Texas, Georgia and North Carolina.

- California and Florida were the states where the average monthly home payment was lower than the average rent.

- But "the gap between monthly rent and ownership costs can be lower than $50 in some states, so buying a house can sometimes make more financial sense."

The bottom line: Everyone's situation is different, market conditions change all the time, and all real estate is local, so studies like these are more of an interesting reference point than a buyer's guide.

Go deeper: Home sellers reaped record profits in 2020

"much" - Google News

January 11, 2022 at 05:30PM

https://ift.tt/31Rh5q0

Owning is cheaper than renting in much of the U.S. - Axios

"much" - Google News

https://ift.tt/37eLLij

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Owning is cheaper than renting in much of the U.S. - Axios"

Post a Comment