Consumers may soon see the most aggressive Federal Reserve in decades.

Expectations are growing that the U.S. central bank will hike interest rates this year by the most since 2005. How much depends on who you ask: Goldman Sachs is penciling in seven increases, while traders are betting on at least six, according to CME Group’s FedWatch.

Others are starting to speculate that an ugly January inflation number could prompt the Fed to start its tightening cycle with a bang: A whopping half-point increase, the biggest single move since May 2000.

To make 2022 an even busier year for Fed policy, a number of officials expect to start shrinking their massive portfolio of nearly $9 trillion in bonds by sometime later this year, according to records of the Fed’s January meeting.

The ultimate risk, however, is that the U.S. central bank does more harm than good to an economy that’s already experiencing its worst inflation since 1982.

Controlling inflation is top of mind for Fed officials, as price gains nearly quadruple the Fed’s target and show no signs of easing. But the danger is that the Fed could tighten its way into a slowdown, slamming the brakes on the economy too quickly and zapping up too much liquidity all at once. Fiscal stimulus is also fading, while the economy is expected to settle back in at trend-line growth over the next two years, a pace destined to be historically tepid considering longer-run trends of an aging population and globalization.

“The economy doesn’t need the training wheels anymore, but you don’t want to just rip them off,” says Ryan Sweet, senior director of economic research at Moody’s Analytics. “The Fed needs to ease into this. It’s going to be a very challenging year.”

Markets fear that defeating inflation means starting recession

Fears of a recession are far and wide right now. One such example: The 10-year Treasury yield isn’t steepening at a pace as rapid as the 2-year rate, adding to signs that the latter yield might soon outstrip the other. Known as the yield curve, the difference between those key bond yields has long been used as a Wall Street recession indicator. When one flips, it shows that investors are expecting a downturn.

Markets have also been uneasy so far in 2022, as investors wrestle with those building recession risks. The S&P 500 at the end of January sank by almost 10 percent, though has since recovered about one-fifth of its lost ground. An index tracking market volatility out of the Chicago Board Options Exchange is up more than 69 percent so far this year.

Part of the anxiety about inflation all along has been that a downturn is its only cure, likely informed by markets’ bad experiences during the stagflationary-era of the 1970s and 1980s.

Back then, the Fed manufactured what was at the time the worst recession since the Great Depression, hiking its benchmark borrowing rate all the way to a 15-20 percent target range. The idea that expansions don’t just die of old age has long been the lore on Wall Street.

“Not only is it a concern, but the odds favor it,” says Greg McBride, CFA, Bankrate chief financial analyst, referring to recession risks. “Look at the last three [tightening] cycles: Two of them ended in recessions, and the one that didn’t was an economic slowdown, where they had to reverse course and start cutting rates. History is not on their side.”

How aggressive will the Fed be in hiking rates during 2022?

That might be a point in the favor of going aggressive out of the gate in March, McBride says. Raising interest rates in one or two half-point moves might give the Fed more time to wait and see how the economy evolves.

“An ounce of prevention is worth a pound of cure,” he says. If the Fed frontloads rate hikes, “They don’t have to continue to raise interest rates as long or raise them as high and flirt with a much more significant economic fallout.”

Whether the Fed goes big in March or down the road will depend, in part, on consensus. St. Louis Fed President James Bullard showed support for an aggressive Fed move, saying in a Feb. 10 Bloomberg interview that he’d like to see rates increase by 100 basis points by July. Other corners of the Fed, not so much.

“Abrupt and aggressive action can actually have a destabilizing effect on the very growth and price stability we’re trying to achieve,” said San Francisco Fed President Mary Daly in a Feb. 13 CBS interview. She implied that she favored moving more modestly in March, then leaving further moves up to the data.

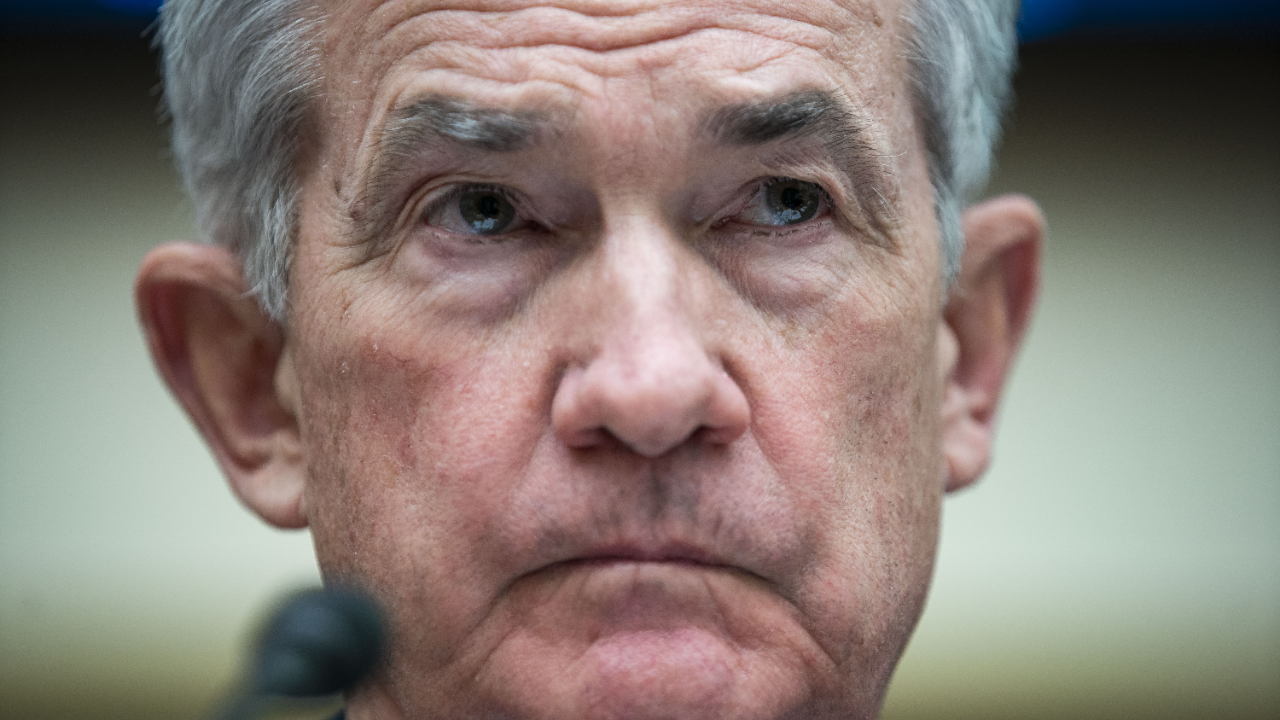

Some officials in the Fed’s January minutes expressed the same concern. Fed Chair Jerome Powell himself has made no commitments. The chief central banker said at the January post-meeting press conference — his latest public appearance — that officials have made no decisions about whether they’d prefer going bigger with a half-point move. Instead, he preached that the pandemic had humbled policymakers’ jobs and recognized that the economy can evolve in ways officials don’t expect.

Fed’s rate moves depend on inflation and employment data

Officials, however, did discuss at the January meeting removing accommodation “at a faster pace than they currently anticipate” if inflation does not come down. All of that shows the Fed’s rate hike pace depends on how the economy evolves.

As of December, Fed policymakers saw inflation drifting down to 2.6 percent later this year, though that was before the Department of Labor’s consumer price index (CPI) showed that prices rose 7.5 percent in January.

While some downward movement is expected as the pandemic and supply chain bottlenecks recede, the prospect that inflation lingers for longer is also high. Many workers are starting to ask for pay increases to account for rising living costs, while a historically tight labor market has led many firms to boost wages. A measure tracking employers’ compensation costs rose 4.5 percent in the final three months of 2021, the most on record.

Even more blockbuster, employers added 467,000 positions in January, suggesting hiring remained resilient despite a surge in new virus cases during the Omicron wave.

The case for being patient: Rate hikes take time to impact economy

On the other hand, higher interest rates take time to filter into the economy. Experts say it may take a year for the full effect of a rate hike to be realized, raising the risk that the Fed tightens too much. That might lead the Fed to take a less aggressive stance, hiking by a quarter point in March.

“If you’re balancing risks and you get less worried about the economy slowing and more worried about inflation just staying high and getting built in to the price and wage-setting process, then you might conclude you need to move faster,” says Bill English, finance professor at the Yale School of Management who spent 20 years at the Fed. “Lags just make the problem harder because you have to be forward-looking and judge where the economy is going to be.”

What to do with your money when rates are expected to rise

It’s not a question of whether rates will go up — but by how much. Take steps now to prepare your finances for a new era of monetary policy, one that will mean more expensive borrowing costs down the road.

- Pay down debt: Consumers with fixed-rate debt won’t feel any impact from a Fed rate hike, but you are more fragile if you have a variable-rate loan. Prioritize paying down that debt, especially a high-interest credit card balance. Consider consolidating that debt with a balance transfer card or to help you make a bigger dent on your principal balance. Homeowners with an adjustable-rate mortgage or a home equity line of credit (HELOC) might be wise to refinance into a fixed-rate loan. “You don’t want to be a sitting duck for higher interest rates on your credit card or home equity line of credit,” Bankrate’s McBride says.

- Take steps to bolster your earnings opportunities: Now’s the time to start maximizing your income to hopefully beat inflation. Take advantage of a historically tight job market to negotiate for higher pay. That might involve hunting for a new position, which has been known to give workers bigger pay gains.

- Boost your emergency savings and find the best place for your cash: High inflation shouldn’t keep consumers from building up an emergency cushion of cash in case of emergencies or unplanned expenses. In fact, rising recession risks only underscore the urgency. Do, however, shop around for the best yield on the market. Online banks tend to offer higher yields for your cash than traditional, brick-and-mortar institutions.

- Think about recession-proofing your finances: Given that plenty of risks lie ahead for the Fed, always be on the lookout for ways that you can recession-proof your finances. Along with building up your emergency fund, experts say it comes down to living within your means, staying connected with your network, identifying your risk tolerance and staying focused on the long haul, if you’re an investor.

“It’s going to be a very challenging task to land this plane perfectly on the tarmac,” Moody’s Sweet says of the Fed’s efforts. “There’s going to be a lot of bumps, where the Fed has to back off on rate hikes or accelerate rate hikes. It’s very unlike the last tightening cycle.”

Learn more:

"much" - Google News

February 18, 2022 at 07:37PM

https://ift.tt/VCNuBiH

How much will the Fed raise interest rates in 2022? Here’s what experts are saying - Bankrate.com

"much" - Google News

https://ift.tt/op1lwxH

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "How much will the Fed raise interest rates in 2022? Here’s what experts are saying - Bankrate.com"

Post a Comment