The latest infrastructure proposal agreed to by the White House and a bipartisan group of senators suggests that an additional $100 billion could be collected by the IRS over the next 10 years by simply beefing up enforcement and making sure the government is collecting what taxpayers actually owe -- also known as closing the "tax gap."

Biden also suggested earlier in the year that if he could boost the IRS's budget by $80 billion to pay for enforcement, he could increase revenue for the government by $700 billion over 10 years -- money he'd use to fund his American Families Plan, which would invest in child care, pre-K and colleges.

But it's unclear exactly how much could be raised and how much it would cost to increase enforcement. Here's how it could work:

How much in taxes goes unpaid?

The difference between taxes owed by law and the amount actually paid to the IRS -- known as the "tax gap" -- could fall somewhere in the range of $381 billion to $1 trillion annually.

The latest IRS report available says that nearly 84% of federal taxes are paid voluntarily and on time, leaving $441 billion uncollected. After late payments are made and enforcement actions taken, the gap narrows to $381 billion, according to the report.

But that's based on tax years 2011, 2012, and 2013 and IRS Commissioner Chuck Rettig told lawmakers earlier this year that he believes the tax gap could be much bigger now -- up to a massive $1 trillion a year.

One reason the earlier report may underestimate the tax gap? There's been an increase in the use of virtual currencies since 2013, which comes with new compliance challenges. The earlier estimates may have also underestimated unreported offshore income and the use of pass-through entities.

The Biden administration has put the figure somewhere in the middle. A recent Treasury analysis found that the tax gap totaled nearly $600 billion in 2019 and could rise to about $7 trillion over the course of the next decade if left unaddressed -- roughly equal to 15% of taxes owed.

How much more can actually be collected?

It's unlikely the IRS will ever be able to get the tax gap down to zero, no matter how much it ramps up enforcement.

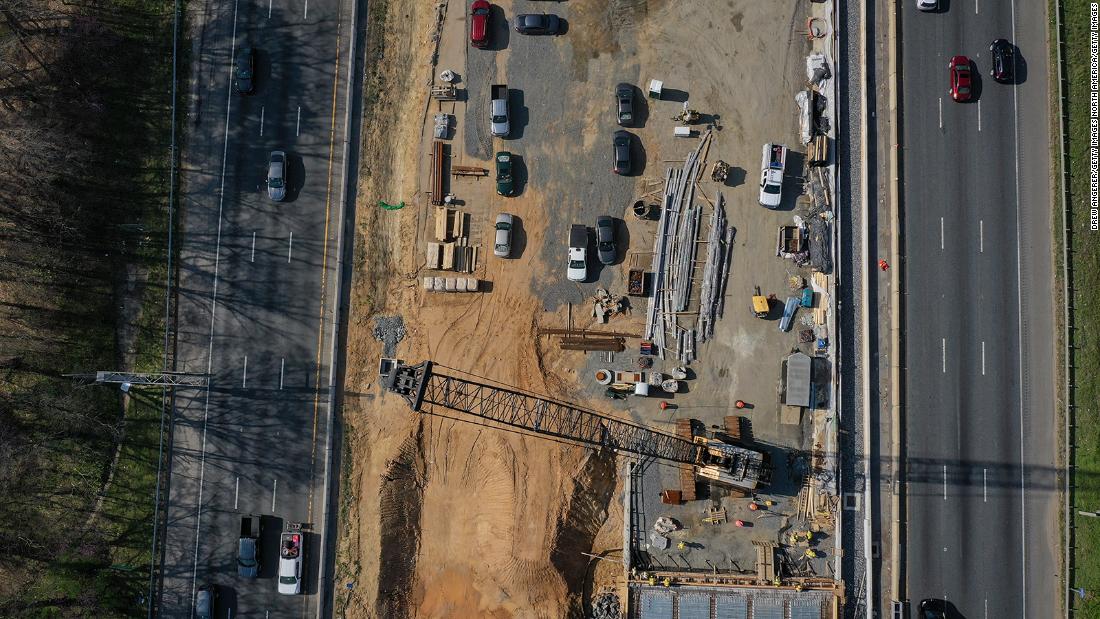

The agreement struck between a bipartisan group of senators and the White House indicates that they believe another $100 billion could be collected over 10 years -- and they plan to use that money to help fund investments in infrastructure.

"We think that's right in the ballpark," said John Ricco, associate director of policy analysis at Penn Wharton Budget Model, which analyzed the bipartisan proposal.

A separate report from the Congressional Budget Office also suggests this is possible, though it depends on how much is spent to beef up the IRS. It says the agency could collect another $61 billion over 10 years if it spent $20 billion more on examinations and collections, or another $103 billion if it spent $40 billion over 10 years.

Who's not paying?

The tax gap sheds light on how some people and businesses aren't paying their fair share. But it's not entirely the result of bad actors trying to evade the tax man. Inadvertent error accounts for some of it, too.

"Failures to comply with tax law often involve unintentional mistakes that are the result of not fully understanding what has come to be an extremely complex tax code," Rettig wrote in a recent memo.

Most unpaid taxes result from individuals reporting less income than they earned, especially business and self-employment income. About 9% of the gap is a result of failing to file and 11% of underpayment of taxes that were accurately reported, according to the Committee for a Responsible Federal Budget.

The Biden administration has said it would target the wealthy with more enforcement. A report from former Treasury Secretary Larry Summer and Natasha Sarin, an assistant professor at the University of Pennsylvania, found that high-income earners are more likely to under-report their income because more of it comes from opaque categories like dividend income, capital gains, and proprietorship income.

Can the IRS catch up?

The agency is strapped for cash and will need a bigger budget to hire more staff if it wants to close the tax gap.

Its budget has shrunk 20% over the past decade, resulting in a 22% staff reduction. With fewer people working on enforcement, the share of individual income tax returns it examined fell by 46%, and the share of corporate income tax returns it examined fell by 37% between 2010 and 2018, according to the Congressional Budget Office.

The agency became even more burdened during the pandemic, when many of its employees were sent to work from home while Congress added to its workload by tasking the IRS with distributing three rounds of stimulus payments and the new, expanded child tax credit.

"much" - Google News

July 05, 2021 at 07:00PM

https://ift.tt/3yCUWGL

How much money could Biden raise for infrastructure through tougher IRS enforcement? It's not clear - CNN

"much" - Google News

https://ift.tt/37eLLij

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "How much money could Biden raise for infrastructure through tougher IRS enforcement? It's not clear - CNN"

Post a Comment