Americans aren't confident they have enough money to retire.

In fact, only 47% of retirees think they've built a large enough nest egg to last the rest of their lives, according to a 2020 survey conducted by the Transamerica Center for Retirement Studies.

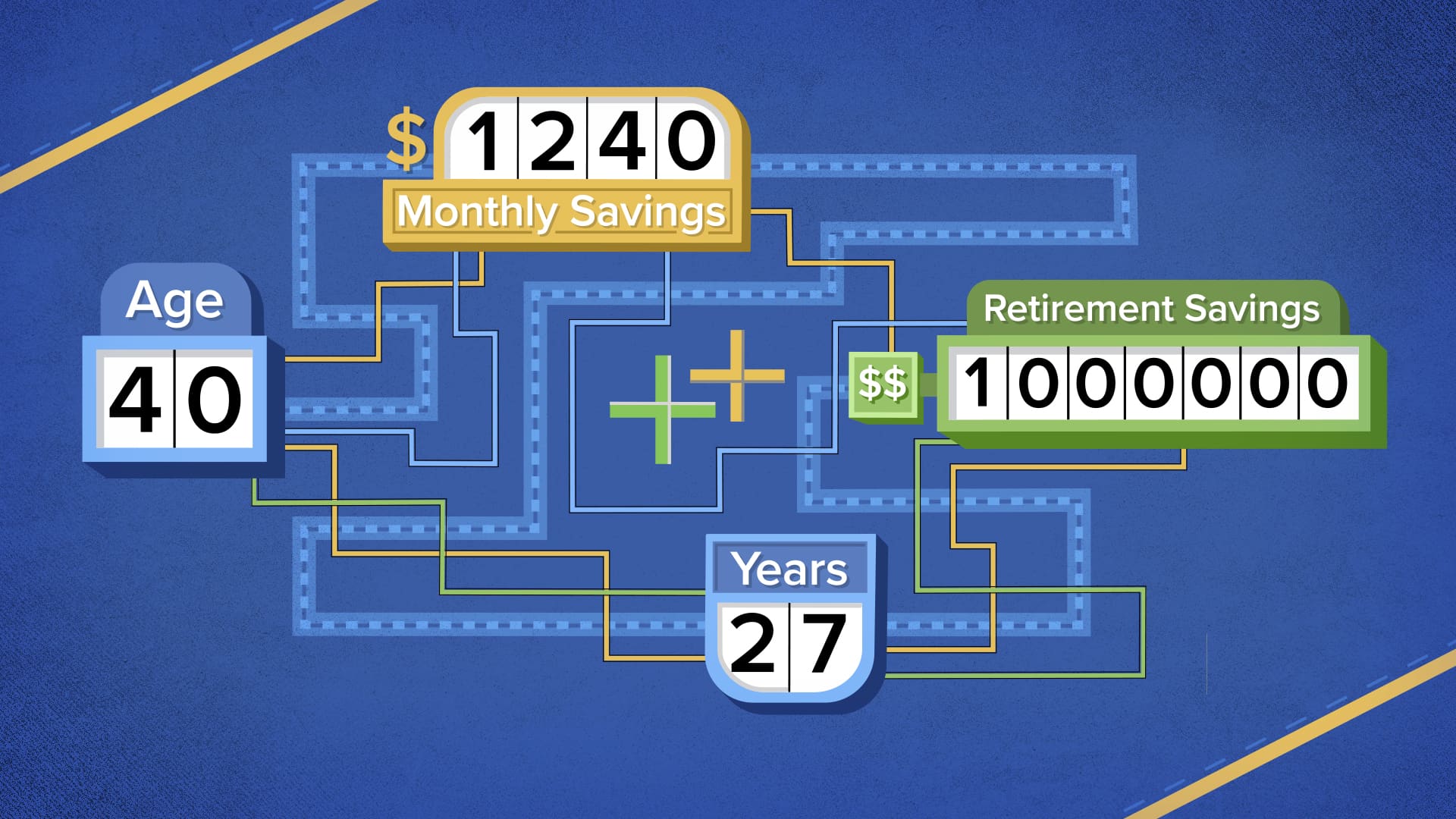

If your goal is to save $1 million, you'll need to start investing early. NerdWallet crunched the numbers, and we can tell you exactly how much money you'll need to save per month, broken down by age.

First, let's go over how they got the numbers. The math assumes you are starting with no money in savings, that your investments will earn 6% annually, and that you plan to retire at age 67.

Check out this video to dive into the figures.

More from Invest in You:

Josh Brown: Sometimes the best returns come from CEOs you've never heard of

The power of compounding can help you double your money, again and again

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

"much" - Google News

September 22, 2020 at 09:00PM

https://ift.tt/32Szu3p

Retiring with $1 million: How much you should save every month, broken down by age - CNBC

"much" - Google News

https://ift.tt/37eLLij

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Retiring with $1 million: How much you should save every month, broken down by age - CNBC"

Post a Comment