Cadence Bancorp. officials made a tough call at the start of 2021.

After Congress approved funding for a second round of Paycheck Protection Program lending late in December, the Houston-based Cadence opted not to participate, even though it had made $1.1 billion of PPP loans in 2020. The $18.7 billion-asset company’s Small Business Administration lenders helped clients obtain PPP loans at other institutions, to be sure. Beyond that, they largely reverted to their prepandemic role as traditional SBA lenders just as interest in the 7(a) program was heating up again.

“It was an uncomfortable moment,” recalled Alan Thomes, Cadence’s managing director for SBA banking. “We had a handful of customers who probably would have preferred we did PPP directly, but in the grand scheme of things most of our clients seemed to be happy.”

Ultimately, “it was a business decision that had to be made,” Thomes said — and it proved to be a timely one.

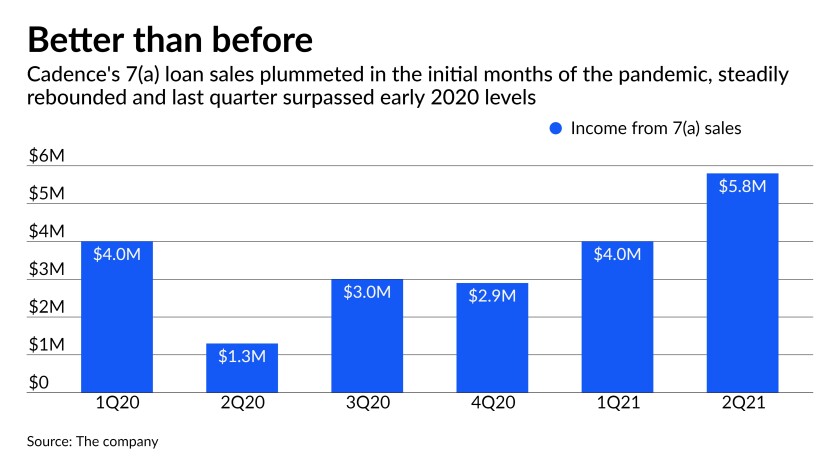

As part of its second-quarter results issued Thursday, Cadence reported a record $5.8 million in SBA lending income, up 45% from the first quarter and 346% from the second quarter of 2020, when the coronavirus pandemic shook the economy.

Cadence is by no means alone. The 7(a) program is in the midst of a resurgence that’s benefiting the bottom lines of a number of other SBA lenders including Hope Bancorp in Los Angeles, Live Oak Bancshares in Wilmington, North Carolina, and the megabank Wells Fargo at a time when commercial loan growth industrywide has been spotty.

In a weekly lending report released Wednesday, the SBA reported that fiscal-year-to-date 7(a) volume topped $20.95 billion, 34% higher than the same period in fiscal 2020. (Lending volume finished at $22.6 billion in the full fiscal 2020, its lowest level in six years.)

This year's performance is also 7% ahead of the pace for fiscal 2017, when the agency guaranteed a record $25.4 billion of 7(a) loans.

“SBA as a whole is up across the industry, and we were in a position to take advantage of that,” Thomes said.

The $17.5 billion-asset Hope reported a substantial increase in 7(a) lending in its second-quarter results Wednesday, which helped boost sales on the secondary market. Hope said it originated $77.7 million of 7(a) loans in the quarter that ended June 30, more than double its first-quarter production of $36.8 million.

The lending uptick allowed Hope to resume selling loans on the secondary market, which in turn generated gain-on-sale revenue totaling $2.4 million. Hope sold $30 million of 7(a) loans between April and June and expects to sell a similar amount quarterly going forward, according to Chairman and CEO Kevin Kim.

“We believe that the current SBA premium levels will sustain for the time being,” Kim said Wednesday on a conference call with analysts.

A similar story unfolded at the nation’s largest SBA lender, the $8.2 billion-asset Live Oak. It reported second-quarter SBA originations totaling $503 million Wednesday, up 182% year over year.

Strong secondary loan sales netted Live Oak $15 million for the quarter that ended June 30.

Live Oak reported a record $63.6 million second-quarter profit. Hope’s net income totaled $53.8 million, double the $26.8 million it reported for the second quarter of 2020. Cadence bounced back from a $56.1 million loss a year earlier to post a $101.3 million second-quarter profit.

Wells Fargo, too, is reporting higher SBA activity across the board. “The increased awareness of the benefits of SBA products is driving business-owner demand for SBA financing, which provides favorable terms for customers,” Don Fracchia, division executive of Wells’s SBA lending group, said in a statement to American Banker.

The 7(a) program is SBA’s largest loan program, offering partial guarantees on loans as large as $5 million to qualifying small businesses. Banks make the loans upfront and collect the guarantees in instances when borrowers default.

While the 68-year-old program has proved popular with lenders and borrowers, it’s been especially attractive in fiscal 2021, as Congress waived user and borrower fees and provided funding to defray several months of payments for new borrowers, part of the government’s pandemic-related stimulus effort.

The loan-payment program is scheduled to sunset on Sept. 30, the final day of the 2021 fiscal year, leading some analysts to question whether its elimination might take some of the steam out of the current 7(a) boom.

Kim, however, says the program will remain plenty strong even without the government’s temporary enhancements.

“Looking at the excess liquidity in the market and the few investment opportunities, [7(a)] … will be a very attractive product to invest in,” Kim said. “We expect that premium levels will continue to be high.”

Live Oak President Huntley Garriott said he also expected SBA activity to continue at elevated levels.

“Our loan pipeline continues to be near our all-time high, even after the quarter we just came off,” Garriott said Thursday on a conference call with analysts.

“As the SBA enhancements are scheduled to end, we expect that to impact volume to some extent and our secondary-market pricing as well,” Garriott added. “But we feel really confident our franchise is in a great spot to continue providing capital for small businesses.”

"much" - Google News

July 23, 2021 at 02:00PM

https://ift.tt/2UEaFH2

Near-record SBA lending gives banks much-needed earnings jolt - American Banker

"much" - Google News

https://ift.tt/37eLLij

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Near-record SBA lending gives banks much-needed earnings jolt - American Banker"

Post a Comment