(Bloomberg) --

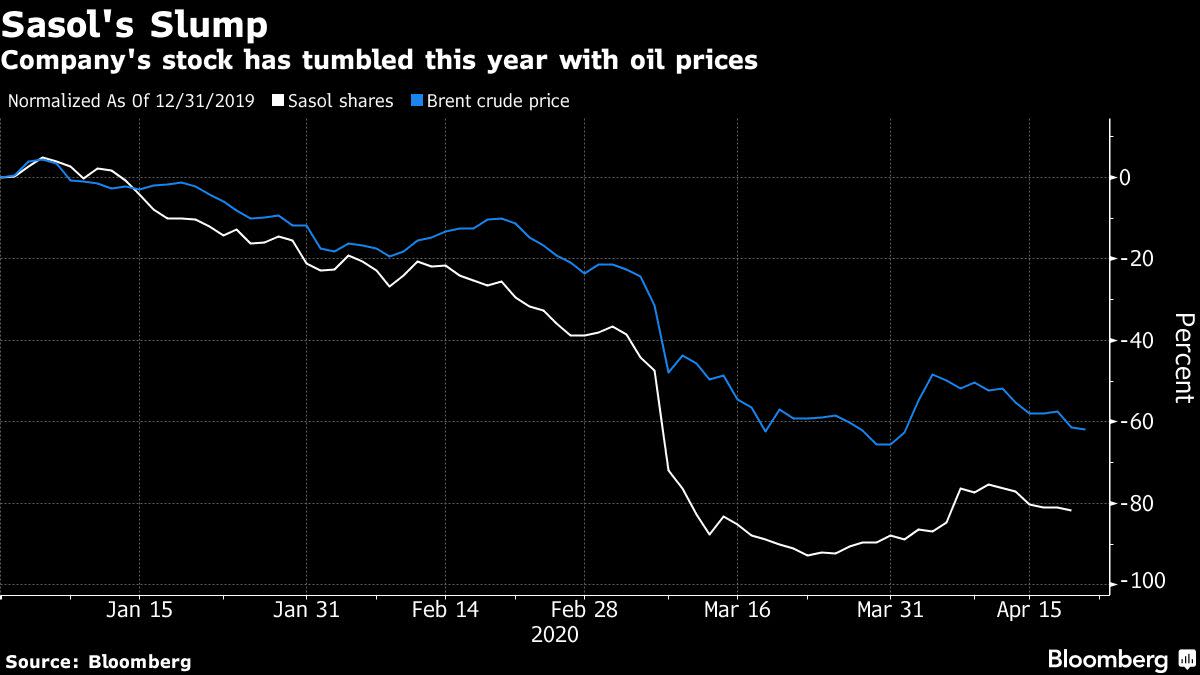

Sasol Ltd.’s shares, down more than 80% in 2020, are trading as if the market expects years of bad news around oil and that the South African fuel and chemicals giant will struggle to escape its balance sheet constraints.

Old Mutual Investment Group doesn’t share that pessimism, said Meryl Pick, a money manager who helps oversee the firm’s 10 billion rand ($533 million) Investors Fund.

“Our view is that the market is pricing Sasol as if the prevailing oil prices are going to continue for the next three to five years, and are pricing in that the balance sheet constraints will prevail for a very long time,” Pick said by phone from Cape Town Monday. “We do not believe that oil prices will remain at these low prices into perpetuity.”

Sasol’s plunge has made it the worst-performing stock this year in Johannesburg and wiped more than 150 billion rand from its market value. Spiraling costs at a U.S. chemicals project have surged about 50% above projections to almost $13 billion, while oil prices have crashed as the coronavirus pandemic destroys global energy demand.

A gradual revival as countries reopen their economies and reduced production from U.S. shale oil companies will support the market for crude, said Pick.

“On a three to five-year view, it is unlikely that we will be in the extreme lockdown scenario that we are now seeing and oil demand will recover,” she said.

Sasol said last month it plans to raise $6 billion by the end of its 2021 financial year, including a share sale of as much as $2 billion, as it seeks to reduce net debt of about $10 billion. It’s also in negotiations with lenders to arrange greater flexibility over its repayments.Read more here about Sasol’s capital-raising measures

“Most of the debt is in the U.S. and it is quite low-interest-rate debt,” said Pick. “So there is room to take higher finance costs in exchange for more relaxed risk metrics on the debt.” Success in reducing costs, cutting capital spending and selling some non-core assets would help reduce the size of any rights issue, she said.

Sasol has hired Bank of America Corp. to help find a buyer for a minority stake in the Lake Charles Chemical Project, people with knowledge of the matter have told Bloomberg News. Sasol would prefer finding an industrial partner for the stake and may structure any deal as a joint venture, one of the people said.When it comes to any potential share sale, Pick estimates that at worst, Sasol may need to raise as much as 140 billion rand. But she envisages that the amount could be as low as 20 billion rand in a “last resort” option that won’t be carried out before August.“The key thing will be what they agree with lenders,” Pick said. “If lenders give them a reprieve, then the rights issue will not be that urgently necessary.”

Sasol was 1.7% lower as of 3:51 p.m. in Johannesburg, paring declines of as much as 24%. The stock has slumped 82% since the start of the year.

(Adds reported appointment of Bank of America for sale of stake in Lake Charles project, updates shares.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

"much" - Google News

April 21, 2020 at 02:12PM

https://ift.tt/2zihJhy

Sasol Investor Says Shares Are Pricing In Too Much Bad News - Yahoo Finance

"much" - Google News

https://ift.tt/37eLLij

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Sasol Investor Says Shares Are Pricing In Too Much Bad News - Yahoo Finance"

Post a Comment