The US SIF Foundation, a membership group of investment professionals, released its biennial report on Sustainable and Impact Investing Trends on Monday. It focuses on how investors are considering environmental, social and governance issues, also known as ESG, when deciding where to park their assets. The 2020 report found investors are considering ESG factors at a 42% higher rate compared to 2018, and ESG investing now covers a third of all assets under investment in the U.S.

To learn more about the report and ESG’s impact on professionally managed assets, “Marketplace Morning Report” host Sabri Ben-Achour spoke with Lisa Woll, CEO of US SIF. Below is an edited transcript of their conversation.

Sabri Ben-Achour: When we say that investors are considering an issue — climate change, labor issues — what do we mean by that [in regard to] where they place their money?

Lisa Woll: Right. So there’s two ways that you can utilize what we call ESG criteria. How do you incorporate an environmental, social, governance issue into an investment? And one of those is in how a fund portfolio gets constructed. What kinds of companies are in there? Then the second piece is, how do you engage with this company? Do you engage with this company? So many of, for example, US SIF members undertake something called shareholder engagement, where they engage with companies, they might bring a resolution to vote at an annual meeting. And that’s on a very specific action that they want a company to take, such as measuring its carbon footprint, or ensuring that senior-level staff and board are diverse, or that CEO pay is not disproportionate to everyone else’s pay, or that human rights in a supply chain are being assessed and looked at whenever a company is creating a good.

How to make sustainable investments

Ben-Achour: So if I wanted to do that, there are, for example, funds out there that are, you know, invest in this fund if you want to promote companies that take labor rights seriously, something like that?

Woll: Yes. So if you went to the US SIF website, for example, at USSIF.org and you looked at our list of mutual funds and then exchange-traded funds, ETFs, you would be able both to find a bunch of our members’ funds, but also the criteria they look at and whether they bring shareholder resolutions as well. And if you own individual stocks, that is the way you would bring a shareholder resolution. You need right now to own at least $2,000 in stock in a particular company. Although that has been changed by the [Securities and Exchange Commission], you do need to own individual stock in general to bring a shareholder resolution.

Ben-Achour: A 42% rise since 2018, that sounds staggering. What’s driving that?

Woll: I think that’s in part because there hasn’t been very much public policy, any really, that has been addressing the climate crisis, the racial injustice crisis. Certainly we have been grappling with a pandemic, which has sown economic inequality. So I think people, as a group, are trying to figure out how they could have impacted so many really critical issues in the absence really of national federal policy. So I think that had something to do with it.

I also think we’re seeing a proliferation of investment products, making it easier for a range of investors to find opportunities to invest. And also groups like US SIF over the last seven to eight years have made it an immense priority to educate both financial professionals and nonfinancial professionals. So we have courses for advisers, we have the only designation in the United States along with the College for Financial Planning for financial advisers, so that they can create knowledge with their clients and invest in their clients’ assets in a sustainable way. And we just last year, earlier this year actually, launched the first free course for retail investors. So that’s someone who just wants to know the basics, in very general and accessible language, can go take our free 30 minute course and look at how they might invest whatever discretionary assets they have in a sustainable fund or a community investing node, or something like that. So that has also expanded the knowledge of the field across a broad range of investors and increased the asset flow as a result.

Investments related to climate change and carbon emissions

Ben-Achour: So out of all the issues that investors are thinking about — human rights, labor, environmental responsibility, what’s the biggest one of all?

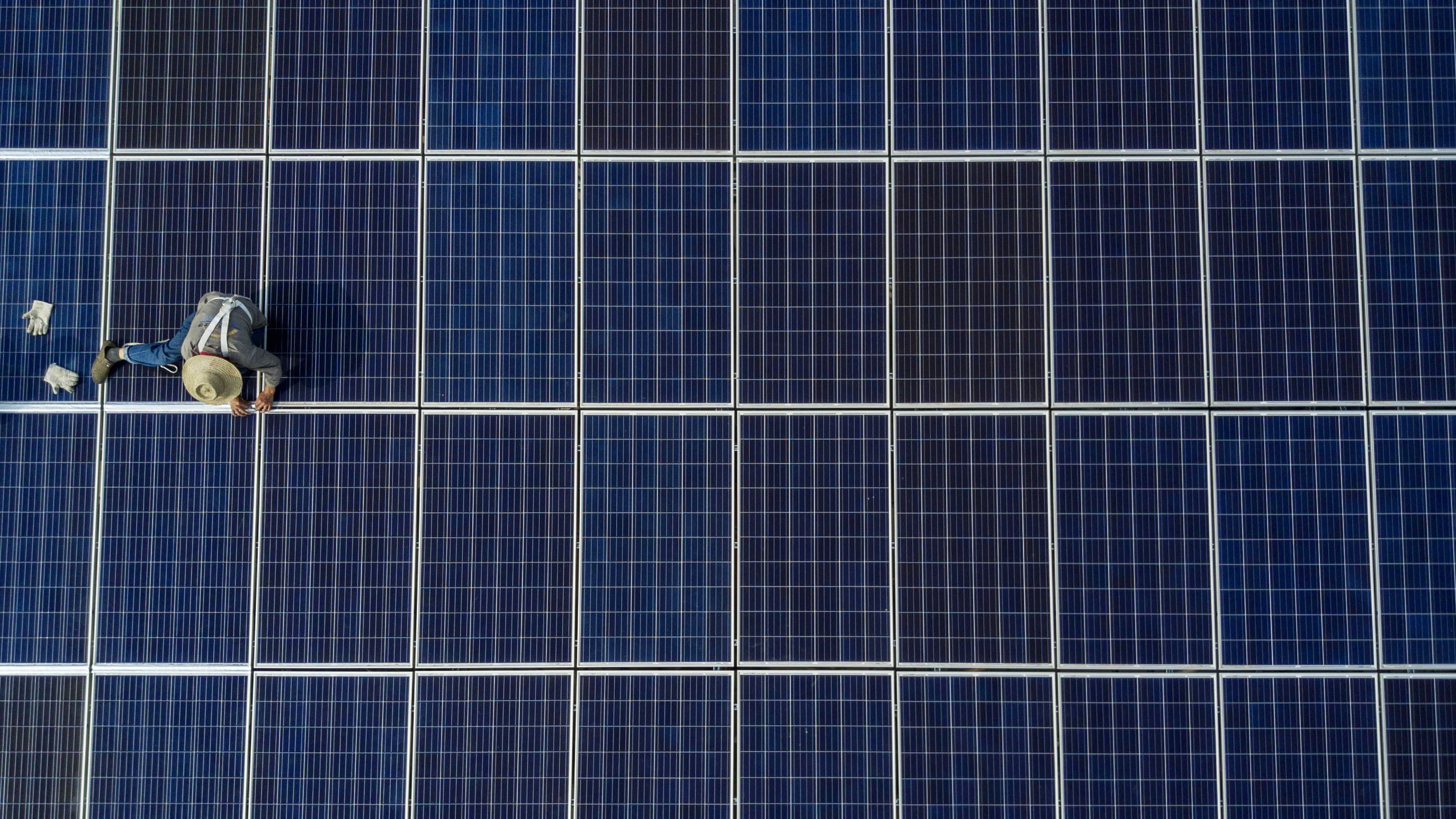

Woll: Well, for money managers who control most of the assets that are accounted for in this report, climate change and carbon was the number one issue, accounting for $4.18 trillion in this specific ESG criteria. That was followed by anticorruption and then board issues, sustainable natural resources and agriculture and executive pay.

Ben-Achour: So if you’re choosing to invest in companies on a climate change basis, what kind of companies does that mean you’re investing in?

Woll: The answer is it depends what the fund is focused on. So you may be finding a clean energy fund which is really focused on clean energy, you may find a fossil-fuel-free fund. So they’re not investing in any fossil fuels, they might not be investing in any companies that transport those fossil fuels, for example. Others are going to choose a broad base of companies that perhaps have the best climate policies at their companies, or a small group of companies that are really integrating a climate focus throughout the entire company through all of their actions. So it’s a multifaceted answer because there are multiple types of funds approaching the climate change issue from different perspectives. Like any investment, an investor should carefully read a prospectus to really understand the fund’s approach to a particular issue that they’re interested in.

Ben-Achour: The Trump administration just last week finalized a rule that says people investing on behalf of private pension plans, 401(k) plans, cannot invest in ESG funds that take on additional risk or sacrifice returns for the sake of some of these other goals. What do you think of that? And would that limit ESG investing?

Woll: I would say they muddy the water. The original proposal that came out actually stated ESG funds as the focus. The actual rule that came out was a little more general. But we absolutely think that under the Biden administration, the rule needs to go back to what the guidance was previously that made it really clear that ESG criteria were able to be considered as long as, you know, it was not liable to do damage to the returns. We’re waiting for rule-making around being able to vote your proxies in an ERISA-governed pension plan. We expect that will come out sometime in the next few weeks. And again, we are going to be recommending and we have recommended in our policy document for the new administration that they reverse whatever rule comes out on the proxy voting and go back to the stipulated guidance from 2016.

As a nonprofit news organization, our future depends on listeners like you who believe in the power of public service journalism.

Your investment in Marketplace helps us remain paywall-free and ensures everyone has access to trustworthy, unbiased news and information, regardless of their ability to pay.

Donate today — in any amount — to become a Marketplace Investor. Now more than ever, your commitment makes a difference.

"how" - Google News

November 16, 2020 at 08:49PM

https://ift.tt/3pBjxaU

How to invest in a better world - Marketplace

"how" - Google News

https://ift.tt/2MfXd3I

https://ift.tt/3d8uZUG

Bagikan Berita Ini

0 Response to "How to invest in a better world - Marketplace"

Post a Comment